These KPIs provide important insights into everything from finances to operations.

If you’re a banking institution, how can you really put your finger on performance? Or be sure you’re compliant with federal regulations? You’ve got to know your numbers. More specifically, those numbers that are key performance indicators (KPIs) for the banking industry.

A multitude of KPIs can be implemented to measure every type of transaction and service in a bank to accurately evaluate performance, profit, customer service, and more. It can be hard to choose which measures to focus on, so here’s a list of bank KPIs you should track, organized by category.

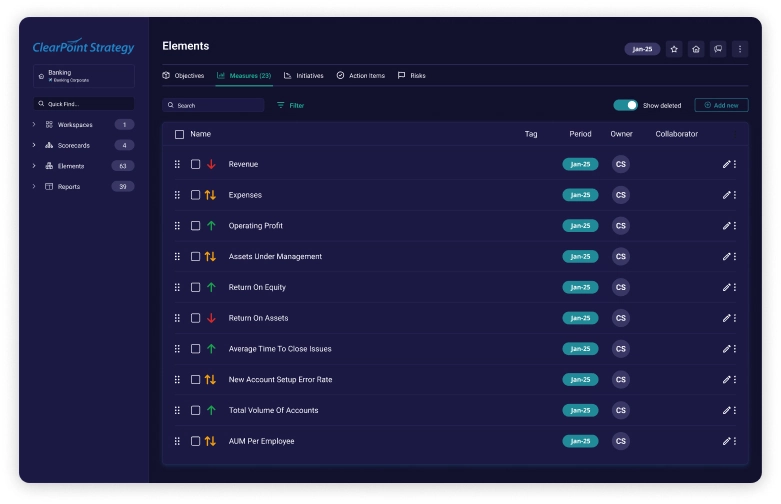

Introducing ClearPoint Strategy, the ultimate tool to help you track and manage these critical KPIs effectively.

ClearPoint Strategy offers a comprehensive platform to help banks define, track, and manage these KPIs efficiently. With ClearPoint, you can automate data collection, create customized reports, and gain valuable insights to drive strategic decisions. Here are 17 essential KPIs every bank should track to ensure they meet their financial and operational goals effectively.

See ClearPoint Strategy in action! Click here to watch a quick DEMO on the software

We'll now share with you 17 metrics that are applicable to banks of all sizes and cover the most important aspects of operations and management:

17 KPIs Every Bank Should Track

Financial

- Revenue: All incoming cash flow. For banks, you might break down your total revenue by deposit interest, loan interest, service fees, and transaction fees.

- Expenses: All costs incurred during bank operations. Expenses are usually tracked separately in two categories: interest and noninterest.

- Operating Profit: Money earned from core business operations, excluding deductions of interest and taxes. In its simplest form, this figure is obtained by subtracting expenses from revenue.

*Note: The three bank KPIs listed above are the holy trinity. Your stakeholders (such as investors and board) will focus on these metrics more than any others—if nothing else, your bank should track these critical KPIs.

- Operating Expenses As A Percentage Of Assets: Total operating expenses divided by the total dollar amount of owned assets, shown as a percentage.

- Assets Under Management (AUM): The total dollar value of assets being managed by the bank. This KPI can be tracked by various accounting timeframes, such as quarterly.

- Percentage Of AUM Above Benchmark: How your bank’s AUM ranks compared to competitors, shown as a percentage. This banking KPI helps evaluate your performance in the industry.

- Return On Equity: Total income the bank generates divided by the total equity owned by shareholders, shown as a percentage.

- Return On Assets (ROA): The total dollar amount of net income generated by the bank divided by the total assets, shown as a percentage.

Claim your FREE eBook on 68 effective financial KPIs you should use for better strategic insights

Quality

- Client Survey Score: Bank performance as measured by customer feedback. Many banks send out client surveys to gather performance-related feedback; tracking these responses with some type of internal scorecard is helpful. You can even create categories for response types (e.g. employee communication, variety of products/offers, speed of service, etc.) and track them individually, as well as your overall customer satisfaction score.

- Average Time To Close Issues: Length of time from when a problem is identified to when it is solved. Issues may originate internally (operations, technology, etc.) or externally (customers).

- New Account Setup Error Rate: The total number of new customer accounts created containing an error (e.g. typo or incorrect address, name, account type, etc.) divided by the total number of new customer accounts set up at the same point in time, shown as a percentage. This metric will ultimately link to the previous “Average Time To Close Issues” KPI.

- Accounts Opened With Insufficient Documentation: The total number of new accounts opened with insufficient documentation divided by the total number of new accounts opened over the same period of time, shown as a percentage. This is similar to the previous KPI for banks, but in this case, the information is missing versus incorrect.

Productivity By Team Or Individual

- Total Volume Of Accounts: The total number of accounts managed by your bank, tracked by financial timeframes. There are many types of accounts you can track, such as deposit or money market accounts.

- AUM Per Employee: The total dollar value of assets being managed by the bank divided by the number of employees. This is an HR-related measure that helps analyze workload.

- Operating Profit Per Employee: The total dollar amount of operating profits divided by the total number of employees. This is a high-level bank KPI that, in the simplest sense, helps you compare money earned to money spent on staff.

- Sales Per Branch: The total dollar amount of sales generated through a single branch divided by the total number of branch locations. This KPI helps management assess which branches are the highest- and lowest-performing.

- Number Of Workflow Processes Implemented: Counting the processes that the bank has created or revised to improve workflows and better operations. This metric takes a more introspective approach to KPI tracking.

Why Track Key Performance Indicators For Banks

Why go to all the trouble of monitoring KPIs? Because these metrics provide important insights into how your bank and its employees perform. You’ll know what’s contributing to your profit and what’s not, so you can make strategic decisions on everything from hiring to resource allocation.

Ultimately, KPIs evaluate the success of your bank and quantify its performance in tangible ways for your leadership and stakeholders.

Elevate Your Banking Performance with ClearPoint Strategy Software

Ready to optimize your bank's performance with the right KPIs? ClearPoint Strategy is here to guide you. Our comprehensive software solution makes it easy to define, track, and manage key performance indicators that are critical to your bank’s success.

Discover how ClearPoint Strategy can transform your approach to performance management. Book a personalized demo with our experts and see how our software can help you streamline your processes, improve compliance, and drive profitability.

Book your FREE 1-on-1 DEMO with ClearPoint Strategy

FAQ:

What are the top 5 KPIs that banks should track?

The top 5 KPIs that banks should track are:

- Net Interest Margin (NIM): Measures the difference between the interest income generated and the amount of interest paid out to lenders.

- Loan-to-Deposit Ratio: Indicates a bank's liquidity by comparing its total loans to its total deposits.

- Non-Performing Loan (NPL) Ratio: Tracks the percentage of loans that are in default or close to being in default.

- Cost-to-Income Ratio: Measures the bank’s efficiency by comparing its operating costs to its operating income.

- Return on Assets (ROA): Indicates how profitable a bank is relative to its total assets.

How can banks use KPIs to improve their performance?

Banks can use KPIs to improve their performance by:

- Identifying Weak Areas: Pinpointing areas that need improvement based on KPI data.

- Setting Clear Goals: Establishing specific, measurable targets for improvement.

- Monitoring Progress: Regularly tracking KPIs to assess progress and make adjustments.

- Enhancing Decision-Making: Using data-driven insights to make informed strategic decisions.

- Employee Alignment: Ensuring that employees understand and work towards achieving key performance goals.

What are some common challenges that banks face when implementing KPIs?

Common challenges banks face when implementing KPIs include:

- Data Quality: Ensuring accurate and consistent data collection.

- Complexity: Managing the complexity of integrating multiple data sources.

- Resistance to Change: Overcoming resistance from staff to new performance measurement systems.

-Alignment: Aligning KPIs with overall strategic goals and objectives.

- Continuous Monitoring: Maintaining regular and effective monitoring of KPIs.

How can banks measure the success of their KPI programs?

Banks can measure the success of their KPI programs by:

- Achieving Targets: Comparing KPI results against predefined targets and goals.

- Improving Performance: Noting improvements in key performance areas over time.

- Stakeholder Satisfaction: Assessing feedback from stakeholders, including customers and employees.

- Operational Efficiency: Observing enhancements in operational efficiency and cost management.

-Financial Health: Evaluating improvements in financial indicators such as profitability and liquidity.

What are the future trends in bank KPIs?

Future trends in bank KPIs include:

- Digital Transformation Metrics: Tracking digital adoption and customer engagement with online banking services.

- Customer Experience KPIs: Measuring customer satisfaction, net promoter scores (NPS), and retention rates.

- Sustainability Metrics: Incorporating environmental, social, and governance (ESG) factors into KPI tracking.

- Real-Time Analytics: Utilizing real-time data analytics for faster decision-making and responsiveness.

- Advanced Risk Management: Developing more sophisticated risk management KPIs to address emerging financial threats.

.svg)

![Why Strategic Planning Fails (And What To Do About It) [DATA]](https://cdn.prod.website-files.com/637e14518f6e3b2a5c392294/69792f326ab0b1ac3cc24675_why-strategic-planning-fails-and-what-to-do-about-it-data-blog-header.webp)